China Retaliates Against U.S. Tariffs: A Calculated Escalation Amid Trade Tensions : The world’s two largest economies are once again at odds, as China unleashed a series of retaliatory measures in response to President Trump’s decision to impose an additional 10% tariff on all Chinese-made goods entering the United States.

The coordinated actions by Beijing—ranging from tariffs on U.S. energy exports to export controls on critical minerals and probes into American tech giants—signal both defiance and a willingness to negotiate with the new administration.

While the immediate economic impact of these measures appears limited, they underscore the delicate balancing act between escalation and diplomacy. For businesses and policymakers alike, the renewed trade tensions raise concerns about a protracted conflict that could disrupt global markets and supply chains.

Key Takeaways

- Symbolic Yet Strategic : China’s retaliatory measures target narrow sectors like coal, liquefied natural gas (LNG), and certain metals but avoid broader escalation.

- Mixed Signals : While Beijing demonstrates its readiness to fight back, it also leaves room for negotiations by avoiding overly aggressive steps.

- Market Reaction : Asian stock markets initially wavered but largely recovered, reflecting investor optimism that the current moves may remain contained.

China’s Countermeasures: A Closer Look

1. Tariffs on Energy Products

In a direct response to Washington’s tariffs, China announced a 15% levy on U.S. coal and LNG imports, alongside increased duties on crude oil, agricultural machinery, and select vehicles. These tariffs will take effect on February 10.

| Product | Tariff Rate(%) | Impact Analysis |

|---|---|---|

| Coal | 15 | Moderate impact; U.S. exporters can likely redirect shipments to other buyers. |

| LNG | 15 | Potential pressure point; China had planned significant increases in LNG imports before this move. |

| Crude Oil | Increased | Limited effect; only ~5% of U.S. crude exports go to China annually. |

Despite the symbolic nature of these tariffs, LNG stands out as a potential flashpoint. According to Gavekal Dragonomics, China’s LNG imports could rise six- or sevenfold by 2028 if long-term contracts with U.S. suppliers are honored. However, higher tariffs or canceled contracts could disrupt those plans.

2. Export Controls on Critical Minerals

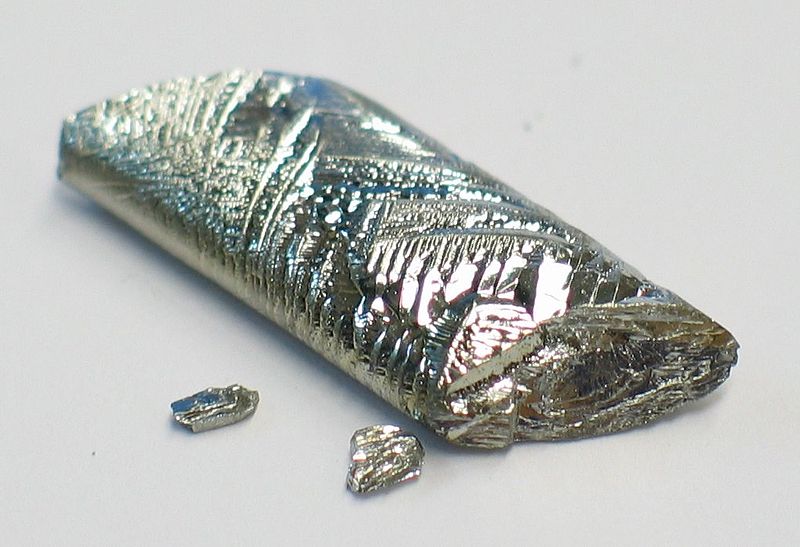

China tightened restrictions on key minerals used in semiconductors, missile systems, and solar cells, including tungsten, tellurium, bismuth, molybdenum, and indium. This move echoes earlier efforts to leverage its dominance in rare earth elements during trade disputes.

| Mineral | Primary Use | U.S. Dependency on China |

|---|---|---|

| Tungsten | Alloys and specialty steels | Declining imports; still reliant on China for supply. |

| Tellurium | Solar panels and semiconductors | Minimal dependency; sourced mainly from allies. |

| Indium | Touchscreens and coatings | Some reliance; mitigated by alternative suppliers. |

Experts note that while these controls aim to send a message, their practical impact on U.S. industries is muted. For instance, the U.S. produces most of its own molybdenum and sources tellurium primarily from Canada and Japan.

3. Probes Into High-Profile Companies

Beijing opened antitrust investigations into Google and added PVH Corp., the parent company of Tommy Hilfiger and Calvin Klein, to its list of “unreliable entities.” These moves target prominent symbols of American technological and consumer power.

- Google : With minimal operations in China since withdrawing over censorship concerns in 2010, the probe focuses on Android’s role in Chinese mobile ecosystems.

- PVH : Accused of boycotting Xinjiang cotton—a claim tied to U.S. allegations of human rights abuses in the region—the apparel giant faces reputational risks despite deriving just 6% of its revenue from China.

Economic Implications: Symbolism Over Substance?

While China’s countermeasures carry symbolic weight, economists agree that their financial impact pales compared to Trump’s sweeping tariffs. According to Capital Economics, the targeted measures affect at most $20 billion worth of annual U.S. imports, a fraction of the $450 billion in Chinese goods under scrutiny.

Moreover, China’s economy remains far more dependent on trade than the U.S., making widespread retaliation risky. As Louise Loo, lead China economist at Oxford Economics, noted, “China’s moves are symbolic, though we expect further tariff measures.”

What’s Next? A Fragile Balancing Act

Both sides appear to be testing each other’s resolve. Trump has described his tariffs as “an opening salvo,” signaling potential future escalations. Meanwhile, reports suggest China is preparing a proposal centered around reviving the unfulfilled 2020 Phase One trade deal—a move aimed at easing tensions.

However, the risk of miscalculation looms large. If Beijing’s measured response fails to deter further U.S. action, Trump may double down on his tariff threats, plunging both nations into a prolonged trade war.

Conclusion: Navigating Uncertainty

The latest round of tit-for-tat measures highlights the complexities of U.S.-China relations. While China’s actions demonstrate strength and restraint, they also reflect vulnerability amid domestic economic challenges. For now, markets remain cautiously optimistic, betting on restrained escalation. But as history shows, even small sparks can ignite larger fires.

Will cooler heads prevail, or will this simmering dispute boil over? Only time—and continued dialogue—will tell.

Related articles

https://mgiedit.org/25-tariffs-on-canada-and-mexico/

https://www.wsj.com/livecoverage/trump-tariffs-us-trade-stock-market-02-04-2025/card/china-hits-back-at-trump-with-new-tariffs-on-u-s–bMzGXD4xeuK6RjQgqXC5

https://www.wsj.com/livecoverage/trump-tariffs-us-trade-stock-market-02-04-2025/card/china-restricts-exports-of-critical-minerals-in-retaliatory-move-e8omEEQJLU911Z1jt4gT

답글 남기기